Blog Goal #2 Achieve - 3000 Hits total

Blog Goal #2 achieved. Who's visitor #3000? He/she appears to be from the west coast.

Blog Goal #2 achieved. Who's visitor #3000? He/she appears to be from the west coast.

After I blew past my first blog goal, I aimed for a much higher target. My 2nd blog goal is to have a total of 3,000 visits. It is a bit of challenge, because I still haven’t reached it yet. I was a little worried earlier this week because I only have a few days left. The counter is currently at 2,930. I need 70 hits within these two days to reach my goal.

I want to talk about the real estate market in NYC since I live here. The prices here for a house is ridiculous. My family has been looking for a house for the past several years and every time we wait for a better entry point the real estate market only gets more expensive. We looked at the houses in Brooklyn recently. A one-family house costs around 500K, a two-family house runs north of 700K, and a three-family house easily goes over 900K. We also looked at other boroughs. In Queens, the prices are even more ridiculous, 500K+ for a single-family home. Staten Island has the most affordable houses, but it is also the most inconvenient location for us to get to the center of the city. Some say there is a real estate bubble and soon it is going to burst. Take a close look at Manhattan. A studio costs 400K, a one-bedroom costs 500K, and a two-bedroom goes for 700K or more. Of course, there are also luxury apartments in uptown that runs in the million’s range. New York City has the most expensive condominiums in the country. Do you think the bubble will burst? Well, let's take a look at the laws of supply and demand. If the demand remains to be strong and supply is short, then the price is likely to be pushed up. There are just too many people in NYC; the population has grown significantly over the recent years. And I believe more people are coming to the city -- people from other states and immigrants from around the world. Many students graduating from college are looking for jobs in NYC. In my company alone, we hire new graduates every year from outside the city. With increase in population, there will increase demand for housing. I know interest rates are going up, but it is still relatively low. And people in general have learned to save up for a house. As the interest rates go up, people will use more cash to buy. Is there a real estate bubble? Well, there is real demand in this market. And from what I’ve seen and heard from real estate agents, people are buying a house to own and live. I would be concerned if everyone is buying a house to flip. That would be a sign when houses are becoming highly speculative. But most people are looking to move to a place they called home and when housing is still a necessity, even if there’s a bubble, the bubble is solid.

I called my friend on Friday to wish her a happy birthday and I thought... I wish there's a way I can play the Happy Birthday song over the phone. Maybe there should be a service where people can select a song and play it over someone's voicemail. For instance, I could just call a company, select a song, and record my personal message. "Hey, I want to wish you a happy birthday. [Music beings and the song plays]." This idea can expand to beyond just a birthday song -- to any song. You can pick a song for a girlfriend, a wife, a best friend, or a niece for graduation. How does it work? You call a company that hosts the service, SEND-A-TUNE (for example). You pick a song from the selection. The selection should include a wide range of music, genre, and artists. You enter the destination voicemail number. You are allowed to record a personal message before and after the song. You make a payment. The payment can be done with a credit card or you can open a membership account that speeds up the process. The song and message gets delivered to the target. Why send a song? Sometimes a song can express your feelings and thoughts. Send a song to confess your love. Send an apology. Send a congratulation message. There are many reasons.

The market is doing terribly today. Most of my portfolio is down for the day. Hopefully, next week would be better.

Blockbuster is offering a huge incentive for switching to their service. If you cancel your Netflix/Walmart subscription and sign up for Blockbuster, you will receive 2 months free and a free DVD of your choice. I cancelled Netflix and signed up for Blockbuster.

Blockbuster is offering a huge incentive for switching to their service. If you cancel your Netflix/Walmart subscription and sign up for Blockbuster, you will receive 2 months free and a free DVD of your choice. I cancelled Netflix and signed up for Blockbuster.

I was cleaning up and I found 8 Loew's movie tickets that are expired (from 2003). I also found one unused full-price ticket. I think my friend didn't show up for the movie that day and we had paid for an extra ticket. Total loss: $50.

I went to the GM AutoShow in Long Island over this weekend. I got to test drive two of their best selections - the lightning-fast Corvette and the giant Hummer2.

When I got into the Corvette, there's a worker accompanying me. I wasn't sure how fast I was supposed to go, but when the guy gave me the signal to go full speed, I stepped on the pedal hard. I heard the engine cranking loudly and I was speeding away. There was a sharp turn, but the handling was really good. It felt like I was going to double over, but the Corvette is very close to the ground with wide tires. I had the chance to go really fast, but the course is short, so it was over soon. It was hard for me to leave the car, I was attached already. I wish I could drive it for longer, but everyone only gets one chance. It was such a tease. Anyone got a Corvette I can play with?

When I got into the Corvette, there's a worker accompanying me. I wasn't sure how fast I was supposed to go, but when the guy gave me the signal to go full speed, I stepped on the pedal hard. I heard the engine cranking loudly and I was speeding away. There was a sharp turn, but the handling was really good. It felt like I was going to double over, but the Corvette is very close to the ground with wide tires. I had the chance to go really fast, but the course is short, so it was over soon. It was hard for me to leave the car, I was attached already. I wish I could drive it for longer, but everyone only gets one chance. It was such a tease. Anyone got a Corvette I can play with?

I also had the chance to test drive the Hummer, but it was a difference experience from the Corvette. They created a small but steep hill and planted bumps on the course. When I was going up the hill, I could see nothing but the sky, and when I was going down, I saw the ground in my front view. There's this incline where driver's side of the wheels go up and it makes you feel the vehicle can climb mountains, but of course that's how they want you to feel. The Hummer is strong and stable.

I also had the chance to test drive the Hummer, but it was a difference experience from the Corvette. They created a small but steep hill and planted bumps on the course. When I was going up the hill, I could see nothing but the sky, and when I was going down, I saw the ground in my front view. There's this incline where driver's side of the wheels go up and it makes you feel the vehicle can climb mountains, but of course that's how they want you to feel. The Hummer is strong and stable.

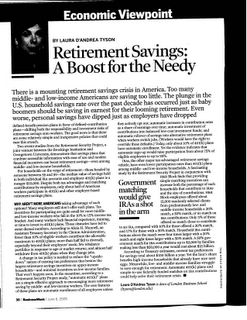

I read a great article today from BusinessWeek. I want to share it with you guys, so I took the time to scan and publish it. It talks about how Americans are not saving enough money for retirement. And the government is offereing incentives like match and/or tax deductions for low to middle income families to put away money for the golden years.

Credits to Flexo for hosting the PDF for me.

Credits to Flexo for hosting the PDF for me.

It is important to get a sufficient amount of sleep every night to ensure we can function properly during the day. But, I usually sleep less than seven hours a day, sometimes even less than 5. I think I have built up such a huge sleep debt it's time to start paying back. I was so tired yesterday I slept for 12 hours. I felt rejuvenated and ready to absorb more information this morning. When I was reading my BusinessWeek on my way to work I was able to read and understand the material quicker. My brain felt like a new sponge and I could think more clearly than ever. Therefore I conclude, getting enough sleep really does help me focus better during the day. "Sleep, like diet and exercise, is important for our minds and bodies to function normally. In fact, sleep appears to be required for survival. Rats deprived of sleep die within two to three weeks, a time frame similar to death due to starvation." "When we get less sleep (even one hour less) than we need each night, we develop a "sleep debt." If the sleep debt becomes too great, it can lead to problem sleepiness – sleepiness that occurs when you should be awake and alert, that interferes with daily routine and activities, and reduces your ability to function." Inadequate sleep can cause decreases in:

ChipMOS TECHNOLOGIES, ticker: IMOS, looks really cheap and has some potential to grow. Any comments? ChipMOS TECHNOLOGIES (Bermuda) LTD (IMOS) Trailing P/E : 9.38 Forward P/E (fye 31-Dec-06): 5.94 PEG Ratio (5 yr expected): 0.45 Price/Sales (ttm): 0.82 Operating Margin: 15.80% Return on Equity: 14.42% Revenue: 487.43M Qtrly Revenue Growth (yoy): 8.10% Total Cash: 153.31M Total Debt: 0 Beta: 0.593

My philosophy of personal finance is to keep things as simple and organized as possible. This way I can keep track of all my credit cards and bank accounts in my head. I would say the numbers should be like this: two to four credit cards, two or three bank accounts, and one or two investment bank accounts. I also like to have no debt, but that would be difficult in the future when I buy a house or start a business. Also, it’s good to have some money put away in savings and retirement accounts. Pay Credit Cards Bills Immediately. I don't play the float. As a matter of fact, my checking account which my paycheck goes to every payroll does not even have an interest rate. Besides, I just like to pay off the debt as soon as possible and get it over with. I don't like to deal with the hassle of remembering to pay near the grace period. Therefore, I also avoid paying late fees and penalties. Say NO to 0% APR Credit Card Offers. I have decided that it's not worth doing a 0% balance transfer from the credit cards. I have enough money to work with, I don't need to borrow extra at this point. Also, I don't like to have too many accounts. And I rather not take a hit in my credit history. Minimize Number of Accounts. I like to keep things as simple as possible. I don't like to keep track of dozens of accounts. I like to have only a few accounts I can remember all the logins. I don't want to deal with too much paperwork either. Online Billing and Automated Debits. I signed up for online billing for all my bills and almost everything is automatically debited every month. The bills get charged to my credit cards whenever possible, and if not, it gets deducted from my checking account. I use MS Money to look at all the bill payments in one screen. I look at the numbers once a month and make sure they're reasonable. If anything goes wrong, I would call my credit card company or the vendor. I like to make paying bills as efficient as possible. Once again, I don't like to spend too much time handling bills. Use Financial Software. I keep track of my earnings and spending in MS Money. I have most of my credit card and bank statements electronically downloaded. I like using MS Money because it helps me keep an up-to-date status of my financial situation and it gives me details of every transaction and helpful reporting tools. Stay Organized. I still receive paper statements and I have a drawer just for them. Every time I get a mail I would just file them there. When the drawer starts filling up, I move them to a shoebox I used for archive. I normally dispose mail after two years. With online statements so convenient nowadays, I probably only need to keep mail for a maximum of one year. Read Financial Magazines. I have subscriptions to Kiplinger's Personal Finance, Smart Money, Forbes, Money, and Business Week. I receive more magazines than I can read. I'm still playing catch up. I bring a magazine to work every day during my commute to and from work. 401(k) Savings. Pay yourself first. I have dedicated 10% of my paycheck to 401k savings. My company offers a match of 25% up to a maximum of $1,000. I have enrolled in the 401k plan as early as possible (when I was working part-time in college) and I have used the technique of dollar-cost averaging into the market to help me take advantage of market volatility. It really does pay to start early and contribute a set amount regularly.

A Dedicated Savings Account. In addition to saving for retirement, I also put some money away in a high-yielding savings account. This is a permanent account where I would save money out and not touch the money unless I absolutely need to. I have designated ING DIRECT as my account holder, and because it's an online bank, it makes it that much harder for me to withdrawal money. Contribute to ROTH IRA. I take full advantage of a tax shelter account. I like the fact that I have an opportunity to invest money and let it grow tax-free. I have been making full contributions every year and I like to contribute at the beginning of the year to allow more time for compounded growth. Keep Cold Cash. I keep about $500 to $1000 of hard cash in case of emergency. The thing is you never know what may happen. Think of it as insurance. I'll give you a quick example. The Northeastern blackout of 2003 has rendered all the ATMs useless. Even if you had money in the bank, it was pointless. If anything like that would happen, I could quickly pull out cash and buy food or anything.Blogger turns quarter of a century old. What do people do when they're 25?

I was born on Flag Day. That's a sign. It's my duty to save the world!!

Previous Forecast 2002 - 30K student loans and 10K CC March, 2005 - 20K student loans and 5K CC End of 2005 - 10K student loans and 2K CC Mid-2006 - 5K student loans and 2K savings End-2006 - 0K student loans and 5K savings Since the last post, I have been paying off the credit card balance. I decided to completely pay off the balance though it was under a 0% offer. I'm trying to stay away from credit card debt and their "generous" 0% APR balance transfers. My current loan balance as of: June 1st, 2005 - approx. 15K student loans and $0 cc debt Current Forecast: Dec 31, 2005 - 10K balance in student loans Mar 31, 2006 - 5K balance in student loans Jun 30, 2006 - finish paying off student loan balance It looks like I'm going to be 6 months ahead of schedule on paying off my student loans. I now expect to be debt free by June 2006 instead of December 2006.

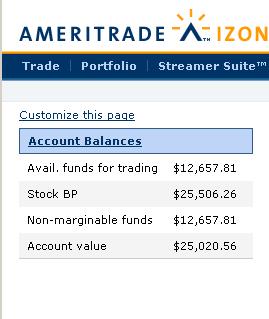

As of June 10th's closing, my Investment Account in Ameritrade iZone has finally reach $25,000, or the day trader's minimum requirement. I wanted to hit this number for some time. Of the total, $22,000 are from deposits over a course of several months. The rest are from capital gains.

This Investment Account is my "play" account where I can take risk and potentially make more money. I want make up a one year investment goal for myself right now. It'll be something I can actively work towards. I'll post my transactions and track my performance on this site.

Okay, here it is. My one year goal, by June 1, 2006, is to have $20,000 in gains starting from today. That would be $45,000 if things remain constant, but I may add more funds. The gains formula is: Total Balance - 25K Starting Balance - Additional Deposits. The road map should look something like this:

This Investment Account is my "play" account where I can take risk and potentially make more money. I want make up a one year investment goal for myself right now. It'll be something I can actively work towards. I'll post my transactions and track my performance on this site.

Okay, here it is. My one year goal, by June 1, 2006, is to have $20,000 in gains starting from today. That would be $45,000 if things remain constant, but I may add more funds. The gains formula is: Total Balance - 25K Starting Balance - Additional Deposits. The road map should look something like this:

I'm holding 1500 shares of GIGA that I recently purchased. Average price is 3.94. I like their fundamentals. If they can put out some good news soon, I think their stock will take off. Some highlights from Yahoo! Finance: Market Cap (intraday): 19.19M Price/Sales (ttm): 0.91 Qtrly Revenue Growth (yoy): 59.90% Total Cash (mrq): 2.54M Total Cash Per Share (mrq): 0.538 Total Debt (mrq): 0 52-Week Change: 148.50% Average Volume (3 month): 571,635 Average Volume (10 day): 49,762.5 Shares Outstanding: 4.72M Float: 3.43M % Held by Insiders: 12.54% % Held by Institutions: 6.20% Giga-tronics Announces Microsource Multi-Year Agreement Award

Looks like my BlogShare value is going up. It's currently value at $4,402.51. Price is at B$40.84 and P/E is 46.38. Most of the shares were sold out. JLP is now the biggest owner of the "company." It'll be interesting if he could buy 51% of the shares and buys me out. Then he'll do a hostile take over. I notice there are Ideas and Artefacts in BlogShares. I have no idea what they are for. I still don't know what is the purpose of accumulating all the B$. It'll be cool if you can trade the B$ for merchandise.

Summer is coming and I want to go somewhere for vacation. I haven't gone anywhere since my last trip to Barcelona last year. Where have people gone in the past few weeks? Any place you would suggest? Any good deals? I'm thinking of Jamaica. My friend said there's a package we can get for $2000. It includes a town house for 7 days, 6 bedrooms, a private beach, chef and maid. It sounds really good.

I'm exploring Fidelity's website and want to see what kind of investment options they offer. Fidelity is well-known for actively managed funds. They seem to have a nice online trading website with a wealth of tools.

I see they have something called Registered Investment Advisors (RIA). If anyone know about or have experience with these type of services, let me know.

I know some wealthy people hire investment advisors or money management folks to invest their money. Where do they find these people? And what do these adisors and folks do to make money?

I'm exploring Fidelity's website and want to see what kind of investment options they offer. Fidelity is well-known for actively managed funds. They seem to have a nice online trading website with a wealth of tools.

I see they have something called Registered Investment Advisors (RIA). If anyone know about or have experience with these type of services, let me know.

I know some wealthy people hire investment advisors or money management folks to invest their money. Where do they find these people? And what do these adisors and folks do to make money?

As per JLP's advice, I called up Vanguard and see if they have a similar variable annuity plan similar to the one offered by Bank of America. It would be nice if they do because Vanguard is known for low fees. Unfortunately, they don't have something like that. The advisor seems to be very professional and lay-back. He didn't do so much aggressive selling as other advisors did. He did not push me to buy any Vanguard annuities. In fact, he suggested VA should be last buys. He talked to me in general what I should do -- buy IRAs, 401ks, first, etc. I'm going to look at the Vanguard Target Retirement Funds, because those funds seem to be an easy way to grow your money with low risk and low management fees. Also, the funds re-balance every so often to reduce risk as the year approaches your targeted retirement date.

PACT has been doing very well for the past five trading days. Look at the 5 day chart.

I sold all my shares already. My total gains so far for this stock is $459.69. I'm planning to rebuy when the price dips.

I sold all my shares already. My total gains so far for this stock is $459.69. I'm planning to rebuy when the price dips.

When it comes to buying stocks I know most people would recommend holding it for the long term, or a year's period to save on taxes. But I think in my case, with the stocks I trade and the strategies for them, I can justify the short term trades. I worked the numbers and it comes out to my favor. See chart for details. Even after taxes of 25% to 30%, the net gains are higher than the long term gains.

Chart

Of course there are risks involve to this style of trading. If the stock explodes upward after I sell then I will miss the boat. That's why I have developed a strategy that consists of both holding and trading. I would hold half the number of shares, for example, and let that half sit and ride the wave up. And with the other half, I would swing-trade with the waves. The psychology behind that is... with the small amount I have, it will take forever to earn money, so I must be aggressive and cash in on the volatility. For a guy with little money to make lots of money in the market, he must play smart and take calculated risks.

But I am very careful with the companies I pick along with this strategy or else it will be ineffective. I primarily look for companies that have high potential growth and have not been price in yet. I like companies with very strong fundamentals and a low P/E. I look at the market cap, profitable margins, debt ratio, float, insider holdings, cash flow, and earnings growth. Then I look at the companies' sector and make sure it's a growing sector. A good company in a declining sector is not going to help. So I make sure that sector is has money coming in and the company has a good chance to make money.

For example, take a look at Cisco:

Chart

Of course there are risks involve to this style of trading. If the stock explodes upward after I sell then I will miss the boat. That's why I have developed a strategy that consists of both holding and trading. I would hold half the number of shares, for example, and let that half sit and ride the wave up. And with the other half, I would swing-trade with the waves. The psychology behind that is... with the small amount I have, it will take forever to earn money, so I must be aggressive and cash in on the volatility. For a guy with little money to make lots of money in the market, he must play smart and take calculated risks.

But I am very careful with the companies I pick along with this strategy or else it will be ineffective. I primarily look for companies that have high potential growth and have not been price in yet. I like companies with very strong fundamentals and a low P/E. I look at the market cap, profitable margins, debt ratio, float, insider holdings, cash flow, and earnings growth. Then I look at the companies' sector and make sure it's a growing sector. A good company in a declining sector is not going to help. So I make sure that sector is has money coming in and the company has a good chance to make money.

For example, take a look at Cisco:

Industry: Networking & Communication Devices (hot and growing). Networking is becoming increasingly more important in areas ranging from small businesses to large business and in government and educational facilities. I mentioned Cisco a while ago (check on my earlier posts) when it was only 17.xx. I bought at the low and mid 17's and sold it at high $18's. Now the stock is at almost $20. I sold all my shares and the stock continued to take off without me, but that was the risk and I was okay with that, because the stock was too expensive for me to have a large holding. Most of the companies I look at are very small, less than 100MM market cap. For a majority of the people, I would still recommend a buy-and-hold stategy, especially when you don't want to deal with all the fuss. For my trading style, there is a lot of research involve and I monitor the stocks very closely. I don't guarantee 100% wins. Nobody can. I'll do my best and I'll see how much money I can make. I'll keep those who are interested in my performance up to date. I'll post my gains and losses. I don't mind talking about my losses, because it is part of growing up money-wise. I will continue to learn and tweak my strategies as necessary. I welcome you all to give constructive criticisms and your strategies for investing.

My limit for PACT kicked in today at $8.50. I also had a chance to pick up more shares at $7.80, and sold it for $8.30. I was actually surprised all my BUY and SELL limits got taken out so soon. Oh wells, at least I profited. Broker: AmeriTrade iZone (previously FreeTrade) account. 5/23/05 BUY PACT 7.60 250 1,905.00 6/1/05 SELL PACT 8.30 250 2,075.00 6/1/05 BUY PACT 8.00 250 2,000.00 6/2/05 BUY PACT 7.80 250 1,950.00 6/2/05 SELL PACT 8.30 250 2,075.00 6/2/05 SELL PACT 8.50 250 2,125.00 Commissions = 6 transactions x $5/transaction = $30 Gross Profit = $420 Net Profit = $390 Here's my loss from yesterday: Broker: Scottrade 5/11/05 BUY AA 28.30 175 4952.5 6/1/05 SELL AA 27.50 175 4812.5 Commissions = 2 transactions x $7/transaction = $14 Net Loss = $126 I've decided to let go of AA on my long term list. I'm planning to add PACT to my long term list. If there is a huge drop, I'll load up on the shares. I'll also use partial holdings to do some swing trades. I know there will be taxes on short term trading, but I can justify the tax costs with higher profits. Taxes alone will not stop me from selling. I’ve made that mistake before. I'm holding a stock where it had gone up to over 100% of my purchase price in less than a year, but I have not sold it. And then the stock had really bad news and it dropped more than 30%. Had I taken profits, I would have to pay 25% taxes (my last year’s tax bracket) on the short term gains, but I would still have come out more money. Therefore, I've come up with a more effective strategy. I will load up a large amount of shares for a fast growing company, and trade with a portion of my holdings. Of course, this will only work with a certain type of stocks, so it is important that I find high growth stocks and buy at low prices. For a different type of stock, you will use a different strategy. High yielding dividend stocks are good buys at huge dips. Accumulate at drops and hold long term. Look at SJT. What a great holding stock. I wish I had loaded up a year ago and I’ll be just sitting here collecting nice dividends. What kind of strategies do you use? What kind of stocks do you buy?

Talk about good timing... I sold PACT at $8.30 this morning and bought it back at $8.00 at noon. The price is currently at 8.08 but it fluctuates a lot. I hope it goes up uP UP. Who else trades stocks here?

I realized my vacation days will expire soon, so I took today off. I'm going to ask my supervisor to allow me to carry some days off to the next cycle so I don't lose them. I have still yet to plan a vacation. I am home now and I have been watching the market since the morning. It is a fabulous day for stocks. Dow Jones, Nasdaq, and S&P500 are up. I decided to rid of ALCOA Inc (AA), because my trading strategy is to buy high growth stocks. AA has also been very disappointing and I decided not to wait for it to rebound. PacificNet Inc (PACT), on the other hand, had a small pop. I sold it at $8.30, netting $165. Isonics Corp (ISON) open sharply higher with super positive news. It is up about 18% at the moment. I don't own any shares, but I've always kept an eye on this company. Very risky play, IMO, but if you can tolerable the risk, it may be worth it.