BlogShares Sign Up

I still wonder what the point of BlogShares is. It looks interesting though, so I signed up for an account, nonetheless. I'm trying to claim my blog, too, and I should receive 1000 shares for claiming it. I looked at some of the richest BlogShares member there. The amounts look ridiculous. Take a look at the top five:

- Laila (B$953,060,218,869,094.00 total value / B$52,087,283,139,722.40 cash balance)

- mars/iris Securities (B$733,775,913,201,747.00 total value / B$8,892,079,668,602.45 cash balance)

- PnP (B$582,102,492,984,145.00 total value / B$116,831,035,031,531.00 cash balance)

- Jim Wright (B$562,571,781,540,032.00 total value / B$2,870,494,361,375.48 cash balance)

- Stan Dandyliver (B$465,554,211,582,388.00 total value / B$49,735,722,143,598.60 cash balance)

Laila has a higher value than Bill Gates and Warren Buffet combined (assuming B$1 = USD$1). I added this  to the right side bar.

to the right side bar.

Betty Crocker Points

I have 15 Points for Betty Crocker cut out from a cereal box. I don't have use for it, but if anyone does, let me know soon. I'll mail it to you and I'll even pay for your postage.

Altantic City

I went to Atlantic City over the weekend with my friends and we went to play Texas Hold 'Em in  . It was the first time for one of my friends so I accompanied her at the 2/4 table. There were two seats available on the table so we sat there. On one of the games, my friend had pocket Aces. She kept raising but she lost to someone who had a straight. On the next immediate round, I had

. It was the first time for one of my friends so I accompanied her at the 2/4 table. There were two seats available on the table so we sat there. On one of the games, my friend had pocket Aces. She kept raising but she lost to someone who had a straight. On the next immediate round, I had  . It was a total coincidence. There was another Ace on the flop so I raised the bet. I claimed the pot with 3 Aces. My friend was so pissed because she lost with pocket Aces on her round. On another hand, I took out a trip Jacks with a full house of Four's. It was pretty fun. I doubled my initial funds at one point, but I gave some back later on. I started to lose my patience after three hours of sitting there and started chipping away money. My friend lost all her money before me and we left at that point. She was complaining about about her loss and her hand with the pocket Aces, so I bought her

. It was a total coincidence. There was another Ace on the flop so I raised the bet. I claimed the pot with 3 Aces. My friend was so pissed because she lost with pocket Aces on her round. On another hand, I took out a trip Jacks with a full house of Four's. It was pretty fun. I doubled my initial funds at one point, but I gave some back later on. I started to lose my patience after three hours of sitting there and started chipping away money. My friend lost all her money before me and we left at that point. She was complaining about about her loss and her hand with the pocket Aces, so I bought her  to make her feel better.

I also played a little bit of

to make her feel better.

I also played a little bit of  . I won some money there. I bet very little though. When it comes to gambling, I play ultra conservatively and I have a cap. In the very end, I netted around $40. One of my friends lost over $200 and was very upset. Another one won over $400 and took all of us out to dinner.

So, as you can see. Sometimes you win, sometimes you lose, but always remember: Casino is not a place for you to get rich. Play for entertainment, not greed.

. I won some money there. I bet very little though. When it comes to gambling, I play ultra conservatively and I have a cap. In the very end, I netted around $40. One of my friends lost over $200 and was very upset. Another one won over $400 and took all of us out to dinner.

So, as you can see. Sometimes you win, sometimes you lose, but always remember: Casino is not a place for you to get rich. Play for entertainment, not greed.

Blog Shares

I was looking at the traffic report and I found something interesting. One of the links came from BlogShares. I was surprised. I didn't even know I have a "company" that was being traded. BlogShares seems like a virtual stock market for weblogs, and in BlogShares the blogs are traded like companies like on Wall Street. I found it amusing. What an idea! But I wonder what is the point? Do you get to trade your B$ for anything?

Anyway, here is my company, Growing Money BlogShares. My B$ price is currently at 43 cents and it has a P/E of .74. Wow, that's a low P/E, but it has a valuation of B$2,906.50. That shows you how much potential it has. Buy me, buy me. =)

Banco Popular - 4.50% APY 2-Year CD

Banco Popular is offering a generous 4.50% yield on a two year CD. The rate looks very attractive.

Banco Popular is offering a generous 4.50% yield on a two year CD. The rate looks very attractive.

Frugal Solution

In light of Frugal Girl's ongoing quest to be as frugal as possible, I have discovered something for myself that will save me more money. I have a few Sharper Image air purifiers at home that I usually clean once a week. It would normally cost me several Bounty Towels to wipe the dust out of the air purifiers. I have tried something else yesterday that would do the job without costing me any paper towels. Every time I finish drying my clothes I would have the anti-static sheets lying around, so I took the used anti-static sheets and used them to clean the air purifiers. The sheets seemed to do a pretty good job surprisingly. I feel so proud.. hahaha... I have reused garbage and turn it into something useful AND saved money. Saving paper towels = saving money. I think I deserved a Frugal Star from Frugal Girl. :-)

PACT Goes Up

PACT climbs up almost 5% today. I actually didn't want it to go up so soon. Why? Because I wanted to load up my second batch of shares at a low price. Why PACT? The company is loaded up with potentials. It has a very good support at the low 7's range. I think it's a safe bet to get in at the 7's. We'll see. I'll still be around. I'll let you know how it does.

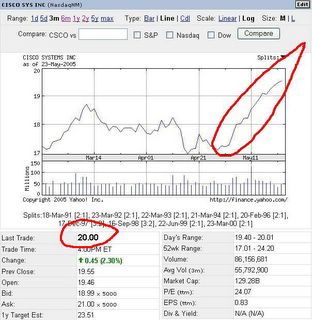

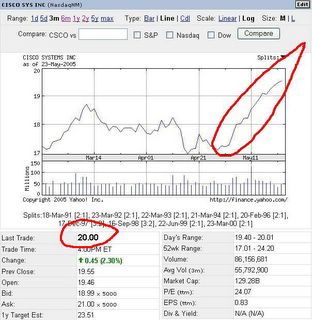

FYI, Cisco is still doing very well. Too bad I already got out of it. I personally wouldn't get into Cisco again until it drops into a price range that is more attractive for me. CKCM is another one I had bought a while ago and now it's up over 60%. I'm not claiming I know everything. I've made mistakes before, and I've lost money. I learned the hard way by rushing into the hype and chasing stocks and getting burned. I have learned to invest more modestly now. I like to pick out stocks that havelittle to no debt, increasing revenue, growing fast, has lots of upside potential, low P/E and are still under the radar. I'm just an investor like many others, but I've learned to do my own research and analysis before I invest in a stock.

Cisco Hits The $20 Mark

Cisco has hit and closed at the highest point today since the beginning of this year, at a whopping $20 a share. I was a little short sighted on selling early, but I'm satisfied at least I ended up with a profit. My friend is holding on to over 500 shares since he bought it at early 17's. He's going to be very happy today.

Bought PACT

I've been looking at PACT very closely these couple of days. There is potential in this company and it should do very well in the long run. The stock price is at a very low point right now. I bought some shares at $7.60 yesterday. Today it is going up.

There are risks involved. This stock has a history of wild fluctuations. Play at your own risk.

Variable Annuity Account

I spoke to a financial advisor from Bank of America today and he suggested a variable annuity account for my parent. He explained to me what is it and how it benefits the owner. The advantages of a variable annuity account is that it allows you to receive fixed annual payments for the rest of your life when you retire. Also, there is this "stepped up" benefit which allows you to receive payments based on the highest account value you had at any time in the account. Say, you had $2M total account value in 2000 and today (2005) you have only 200K left, your payments will be based on the $2M account value. See below for a detailed explanation of a variable annuity account. After knowing the good side of the variable annuity account, I wanted to know the bad side also. It looks like the account eats off high fees, around 2%, and the account is intended to be invested until retirement age of at least 59.5 or else you will suffered from penalties and taxes.

Does anyone have experience with a variable annuity account? Let's hear your stories.

What Is a Variable Annuity?

A variable annuity is a contract between you and an insurance company, under which the insurer agrees to make periodic payments to you, beginning either immediately or at some future date. You purchase a variable annuity contract by making either a single purchase payment or a series of purchase payments.

A variable annuity offers a range of investment options. The value of your investment as a variable annuity owner will vary depending on the performance of the investment options you choose. The investment options for a variable annuity are typically mutual funds that invest in stocks, bonds, money market instruments, or some combination of the three. Although variable annuities are typically invested in mutual funds, variable annuities differ from mutual funds in several important ways:

First, variable annuities let you receive periodic payments for the rest of your life (or the life of your spouse or any other person you designate). This feature offers protection against the possibility that, after you retire, you will outlive your assets.

Second, variable annuities have a death benefit. If you die before the insurer has started making payments to you, your beneficiary is guaranteed to receive a specified amount – typically at least the amount of your purchase payments. Your beneficiary will get a benefit from this feature if, at the time of your death, your account value is less than the guaranteed amount.

Third, variable annuities are tax-deferred. That means you pay no taxes on the income and investment gains from your annuity until you withdraw your money. You may also transfer your money from one investment option to another within a variable annuity without paying tax at the time of the transfer. When you take your money out of a variable annuity, however, you will be taxed on the earnings at ordinary income tax rates rather than lower capital gains rates. In general, the benefits of tax deferral will outweigh the costs of a variable annuity only if you hold it as a long-term investment to meet retirement and other long-range goals.

http://www.sec.gov/investor/pubs/varannty.htm

Ebay Results

Ten days ago, I posted up some items on ebay for sale. The auctions are over and now I'm going to post the results (see table below).

I posted up seven items and five of them were sold. The Sonicare electronic toothbrush was in high demand and received a lot of bids. This shows you how many people want to use an electronic device to brush their teeth. I switched back to manual toothbrushes. Nevertheless, the Sonicare Elite 7500 was sold for $76.50.

I received a few questions about the Motorola cell phone. People were concerned whether they could use it in their area. After answering all the questions, the phone was sold for $14.04 -- a lower price than I expected. This phone used to retail for $299.99, and when I switched phones almost 2 years ago, I could still have sold it for at least $100. Moral of the story: Procrastination costs you money.

I'm surprised the laser pointer received a bid. Hopefully the new owner will find a use for it. I got the item as a gift and never used it. The included battery in the box drained out when I tested it last week. The irock 860 was sold for $39.99. I bought this mp3 player for jogging, but since I got a iPod Shuffle now, I decided to sell it. Unfortunately, I will miss the FM tuner on the irock as the Shuffle does not have one.

Only two items didn't sell. One of them is a coupon, which I posted up as an experiment. The other coupon for Office Depot received a lot of bids however. The other item that didn't sell was the memory stick for laser printers -- not much demand for this expected anyway.

Overall, my net earnings are at $123.38 right now. I still have not received payments for two items, so the totals will decrease a little after the fees, but the net earnings should still be above 100 dollars.

I hope my earnings of a Benjamin bill plus change will satisfy some of the people who made comments and laughed at the 18 cents net earnings I initially posted.

Thanks Nev for the nudge forward. It looks like when I'm not so lazy, I can really make extra money. This idea of ebaying your junk has accomplished me two goals. I have less clutter now and I made some extra bucks for this week. Hmm... I may go for a second round of ebay, since I still have a lot of junk left.

I hope my earnings of a Benjamin bill plus change will satisfy some of the people who made comments and laughed at the 18 cents net earnings I initially posted.

Thanks Nev for the nudge forward. It looks like when I'm not so lazy, I can really make extra money. This idea of ebaying your junk has accomplished me two goals. I have less clutter now and I made some extra bucks for this week. Hmm... I may go for a second round of ebay, since I still have a lot of junk left.

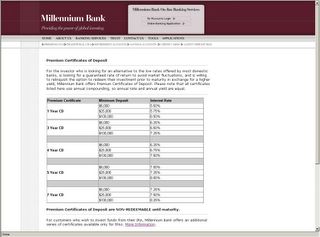

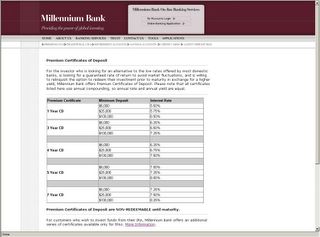

High CD Rates - Millennium Bank

Millennium Bank offers very high rates for their Certificate of Deposits (see below). They pay as high as 8.25% for a 7-year CD with $100K deposit. Even their 1 Year CDs are very attractive, 5.50% for only $5K deposit. I browsed through their website and find out some facts. This bank is not FDIC insured and it is run overseas. My scam detector is on high alert. I would like to know how many people have invested in companies like these. What are the chances of getting your money back? Can anyone find out more details about this company? How long were they in existence?

Next update is going to be the results of my ebay auctions. I know a lot of people are waiting for the results. It's going to be interesting. Let me put everything together and post them up.

Next update is going to be the results of my ebay auctions. I know a lot of people are waiting for the results. It's going to be interesting. Let me put everything together and post them up.

Credit Card Catch - Chase PerfectCard

I have a Chase PerfectCard and one thing I like about it is that it has a straight 1% cash rebate and it's immediately credited to your next billing statement. There's no need to wait until you accumulate up to $100 rebate.

This card sounds too good to be true. I wonder what the "catch" is. Then when I read this letter (see image below) they just sent to me and I realize their business strategy. I feel like I crack the code. There's a part on the letter that states, "Reward dollars... will expire six months after the date they are earned." Unlike other cash rebate cards that write you checks, the Chase Perfect card rebates must be applied as a credit to your future billing statement. Their master plan is to keep you using the card. You need a outstanding balance to take advantage of the rebates. Of course, the more you use it, the more business Chase gets. Ingenious business strategy! What a smart/slick way to keep cardholders charging the cards. And many people use the card for recurring bill payments anyway, so they will not be affected by the "catch."

Chase Letter

Here are the other credit cards, I currently have:

AT&T Universal Card - Great card. Used frequently.

Chase Letter

Here are the other credit cards, I currently have:

AT&T Universal Card - Great card. Used frequently.

- Straight 1% thereafter. Can claim check once rebate accumulates to $50. Best part: 5% rebate intro period for 6-months.

AMEX Blue Card -

Great card. Used frequently.

- 1 point per dollar. Best part: Points do NOT expire.

Discover Card -

Used occassionally.

- Rebates based on a tier system, have to work your way up to 1% rebate. Best part: Double rebate value with gift certificates.

Chase Amazon Card -

Only used for Amazon.com purchases

- 1% on non-Amazon.com purchases. Best part: 3% rebate on Amazon.com purchases.

Featuring: Frugal For Life

Dawn, the author of Frugal For Life has a straight forward approach to a happier and wealthier life - by living below your means and saving as much as you can. Her blog lists many ways you can save money, from clipping coupons to creative ideas for items you would throw away. "Living below your means (lbym) is a fulltime job," she says. Well, a dollar saved is a dollar earned, right? Being a smart shopper/consumer saves you money over the long term.

Okay, pop quiz. Let's work the muscles of the cerebrum a bit.

I have a subscription to Netflix and I return two DVDs in one envelope instead of the two they sent. I'd save each of the extra envelopes in case I'd need it. Now, I have a stack of Netflix envelopes. What creative ideas do you have to best use these extra envelopes?

i.e. Scrap paper? Table cloth?

I also have a large collection of the free AOL CDs. What creative ideas do you have to best use these extra CDs?

i.e. Table coaster? Door stopper? Flying discs?

AdSense Results

As I have expected, the traffic (chart below) for May 11th and May 12th would be significantly increased due to the news coverage from Neville's site. At that time I put up some invading ads in the middle of the contents. My smack-in-the-face ads got 4 clicks which is a 400% increase from the previous 1 click on May 9th. It seems like intrusive ads can earn you a bit more revenue, but I believe it also decreases the value of your site. It tends to repel visitors. I don't like sites with annoying ads myself, so I believe it is more important to keep a site more clean. I would rather have more visitors than earned the few extra pennies. For a total of 1,294 page impressions and 9 clicks, I have earned $2.00. While my site is still young, $2 for the time I have put on AdSense is not a good return.

AdSense Results 5/1/05 - 5/16/05

AdSense Results 5/1/05 - 5/16/05

Important Notice: RSS Feeds Update

I'm planning to update my feed URL to http://feeds.feedburner.com/GrowingMoney. For RSS readers, please update the new address immediately.

Nickel says that it's possible to use the local atom feed and tie it to the feedburner so I will just need to publish one feed URL. I haven't figured out how to do that yet. So in the meantime, please update your RSS Reader to pick up http://feeds.feedburner.com/GrowingMoney

Making Sense of AdSense

I've shrunk the annoying ad to a small box now. I personally don't like web sites oversaturated with ads. I know this is a very good opportunity for many sites to make money with their ads, but it also decreases the value of appeal of the site. I usually ignore ads when I see them. But many sites are making money with ads now, it would be a wasted opportunity not to gain some revenue. However, you would want to make the ads subtle and non-intrusive. Like Cap@StopBuyingCrap.com says, have your ads "blend in your site template or layout" to make a compromise between appeal and revenue.

I tried my best to match the ad background color to my blog's. I can't seem to find the exact code for the color palette, but it's close enough now. I hope it's all easier on the eyes now. Also, I can't add the ads on the right side of my blog, under Sponsors. Does AdSense limit the number of ads you can put up?

I'll report the AdSense revenues tomorrow.

Are You Money Smart?

Can you manage your money as well as you believed?

Many people think that with a large amount of money they can make even more money. They tend to underestimate the skills you need to make this happen. It’s true that if you have money, it is more probable that you will earn more money. But it is in no way a guarantee. If you are to suddenly receive a huge lump sum of money, do you think you can manage the money properly and increase your net worth? Are you sure?

Allow me to point you to this article, 8 Lottery Winners Who Lost Their Millions. Eight people received a large sum of money, but guess what happened? Instead of having more money, they ended up losing everything. What went wrong? Did the Grinch come at night and steal all of it? I don’t think so.

When you suddenly have so much on hand, you are more inclined to spend it. After all, your wish has come true and now you can buy anything you want. You can buy a new car. Oh yes, pick the most expensive one, it’s only $250,000 you have to shell out. Well, guess what, that kind of thinking will hurt you in the long run.

Also, there’s the sudden urge to make more money. So you dive into a business, any business in hopes of generating more income. Do you understand the business? No? Well, you pay the consequences. "Because the winners have a large sum of money, they make the mistake of thinking they know what they're doing. They are willing to plunk down large sums on investments they know nothing about or go in with a partner who may not know how to run a business," says Bill Pomeroy, a certified financial planner in Baton Rouge, La.

And also, your addiction to gambling does not stop just because you win the lottery. Look at Evelyn Adams, she won the lottery twice. I guess once was not enough. You may be one of those people that will just keep gambling with your winnings, and that’s a dangerous financially behavior. It makes you wonder how the casinos survive, right? Let me tell you something, they’ll still be here hundreds of years from now. Why? Casinos captivate the strongest and weakest of human nature – GREED. Everyone goes to a casino to gamble -- to win quick and big. If you lose, you’d want to play again to win. If you win, you’d want to play again to win. Believe me, you’re trapped.

So you see, with poor management you will soon realize your huge pot of money shrinks over time. After all, you’re in money shock. Your lump sum makes suddenly more powerful. And if you don’t control these powers well, you will be become a victim of your own greed. Aside from family issues, your big time purchases and carelessly planned investments will cost you your fortune.

So what should you do if you’re suddenly rich? First, you should sit down and establish a game plan. Learn before you invest! Just because you’re suddenly richer, doesn’t make you suddenly smarter. Do some research, see what options are available to you. Assess the risks and rewards of each investment. Know what you are doing, even if you hire someone to handle the money for you. So at least you will have an idea the financial advisor is working in your best interests.

Just because you’re rich does not excuse you from the basic knowledge of Money Management. Save a portion of your money in a safe high yield savings account. Contribute to your retirement accounts. Think before you buy. Is it really necessary to shell out $250,000 for a Bentley? Can a $75,000 Audi do the job? That’s a savings of $175K. Put the 175 grand to work and you can probably buy another Audi after 12-months. That’s making your money grow.

It's true, no matter what your financial status is, it is very important to develop good financial habits. Keep a note to yourself, and start early. Learn how to manage money even if it is a small amount. You never know. Good habits make successful people.

Money-Making Idea #7 - AdSense

I'm going to explore AdSense as well. I'll have to place the ads more strategically on the site to maximize the number of views and clicks. If this is not making me more than five cents a week but instead this is hurting people's eyes, then I'll revert back to a less ad-intrusive blog.

I spent some time playing around with the ads and placement. It doesn't seem like AdSense allows you to place more than 3 ads in one page. Of all the places, I like the one on the top the most. I also picked a more green color to match the blog layout. I hope more people can see the ads now and it will make more money for me.

MMI #7 completed.

Implementing MMI #5 - Ebay My Junk

To take on Neville's challenge, I've decided to take action on Money-Making Idea # 5: "Ebay Your Junk." I am going through all the items in my apartment and look for items to dump or sell. This project will serve two purposes. First, I clean up my place and clear up some space. And second, I may make some cash. As a bonus, I will a prize from Nev.

I started cleaning up some drawers and picking some items out. I posted the items I don't need anymore for sale on ebay.

Item #1: Kingston Memory Expansion Kit (KTH-LJ4000E/16)

I have 3 of these. It's hard to sell.

Item #2: Sonicare Elite 7500 Power Toothbrush

I have 3 of these. It's hard to sell.

Item #2: Sonicare Elite 7500 Power Toothbrush

This item got a bid shortly after I posted.

Item #3: Motorola V60i Cell Phone

This item got a bid shortly after I posted.

Item #3: Motorola V60i Cell Phone

I should have sold this phone long time ago for good money. It was sitting on my desk for almost two years. Like any tech device, a cell phone goes out of flavor really quickly. The money I can get back on this one is very little now.

Item #4: Laser Pointer

I should have sold this phone long time ago for good money. It was sitting on my desk for almost two years. Like any tech device, a cell phone goes out of flavor really quickly. The money I can get back on this one is very little now.

Item #4: Laser Pointer

I have two of these. If anyone is interested, let me know.

Item #5: irock! 860 MP3 Player (256 MB)

I have two of these. If anyone is interested, let me know.

Item #5: irock! 860 MP3 Player (256 MB)

Very nice MP3 player. I got the iPod Shuffle now, so I no longer use this.

As an experiment, I also posted up some coupons. I have seen a lot of people selling coupons on the web. I don't think it's worth my time for the money, but I did it anyway to check it out.

Coupon #1: Office Depot $15 off (This one is sold for $3.25)

Very nice MP3 player. I got the iPod Shuffle now, so I no longer use this.

As an experiment, I also posted up some coupons. I have seen a lot of people selling coupons on the web. I don't think it's worth my time for the money, but I did it anyway to check it out.

Coupon #1: Office Depot $15 off (This one is sold for $3.25)

Coupon #2: UNO, Borders, and Blockbuster

Coupon #2: UNO, Borders, and Blockbuster

Total Cost and Sales.

Sonicare Elite 7500 is going to sell for at least 29.99 + 5 shipping = $34.99. This makes the net earnings unofficially at $35.17.

Cisco's Strength Carries On

Cisco's volume for the day was 123M, twice as much as the 3-month average of 59M. This shows the huge amount of interest and accumulation for this stock. The stock closed at $18.55, up 34 cents.

Blog Goal Achieved; Blog Goal #2

On May 4th, I posted my blog goal of achieving 1,000 hits by the end of this month. I was at around 800 hits then. In less than seven days, I had more than 200 visits to my site.

I am going to be bold and raise my target to 3,000 total visits by the end of June 2005. I do expect a huge traffic coming in from Nev's site after I complete one of the money-making ideas.

Cisco Earnings Mucho Bueno!

Cisco 3Q Earnings Rise, Beat Expectations

"Cisco 3Q Earnings Rise 16 Percent, Beating Expectations; Sales Jump More Than 10 Percent"

Cisco Beats The Streets by a Penny

"Cisco made 23 cents a share on sales of $6.19 billion in the latest period. Wall Street analysts had forecast a 22-cent profit on sales of $6.16 billion. "

Looks like Cisco is in very good shape and it will continue to grow. The stock price closed at $18.21 (as a yesterday's closed), but the price went up after-hours, to as high as $18.37 and finally settled at $18.25. The volume today was almost 75M about 40% higher than the 3month average volume, indicating that the market has a very high interest in this company right now. Accumulation for this stock is growing because the market thinks it's cheap. With zero debt, $6B in cash, low P/E, high brand-recognition, strong revenue growth, increasing business spending from the market, potential VoIP and other power play, I say this is one company with a very high reward/risk ratio.

Cisco Earnings News and Guidance Today

Cisco has been doing pretty well for these past few days. The stock price has been hovering around low 18's since this morning and it is pretty steady as investors await for the earnings news and guidance today. The key is guidance for the next quarter. If the company provides good numbers for the next quarter, this stock is going to take off.

I'm currently holding 125 shares, bought at $17.85. Ticker now reads $18.15, and it seems to be moving up. I don't care which direction it goes. Up, I'll sell. Down, I'll buy more. In the long term, this stock is going to make me some money.

Work Sucks

Monday morning... and pretty much every weekday.

Poker: Amazing Luck

We celebrated two friends' birthday at someone's house last night. Of course, Texas Holdem was one of the activities since all of us are so hooked in the game. During the game, I have been amazed at the cards I was dealt. I got pocket King's on one hand. I raise immediately and nobody called, so I claimed the pot. Then I got pocket Ace's on the next hand after the pocket King's. I raise again but someone challenged me. I ended up winning with the higher pair. Then at another hand, I had Q,2, both diamonds. Someone went all in, I called, and I got a flush on the flop. I won that hand, despite his pocket King's. On the next hand following that, I got a 4,7. Someone went all in before the flop. I was going to fold but that person dared me!! I had way more than enough chips to spare, so I called him. The flop opened 4,7,7 -- a full house on the flop. I won that hand too, despite his Ace, King.

See, Ace, King are very high cards, but unfortunately even a pair two can beat them. It really depends on the flop. Low cards are usually folds, but if the flop opens low cards, it may not be a bad call after all. You might aruge that high cards have a higher probability of winning. If you have a pair, of course you would rather it be a high pair as opposed to a low one. But this is gambling, nothing is for sure. Sometimes I go in with high cards, and low cards show up on the flop and I end up losing to a pair 2's with a King and Queen. Who knows? Like my previous hand, I went in with a 4,7 and I hit a full house and knocked out a player.

Poker: A True Underdog Story

I was playing Texas Holdem (tournament style) with my friends on Friday night (as usual) and I was down to very few chips. Everyone else got knocked out except me and Kit. His stacked of chips was huge (we had 6 players). I didn't think I would stand a chance with him. I went all in and won that hand. Then I started to win back slowly and eventually I took away all his chips. I totally came back from the underdog. It was a great game!

We played a second game and I won that game too. It was a great night. Total winning was $50.

Cisco Rally

Cisco Systems (CSCO) has rallied for the past two days and has climbed over the $18 mark briefly today. I sold most of my shares at $17.96, and gain a profit of almost $150.

RssReader

With an increasing amount of blogs it becomes a difficult job to keep track of all the blogs you want to read. Normally, you would go to each site to check for updates, and depending on the number of sites you check each day it can be annoying to you. There's a better solution. You can download RssReader (for free), which is a program that allows you to download information straight off the blogs. Sites that are compatible for downloads are usually indicated by  and

and  images.

My feed site is http://feeds.feedburner.com/PersonalFinancesAndInvestments

or http://growingmoney.blogspot.com/atom.xml.

images.

My feed site is http://feeds.feedburner.com/PersonalFinancesAndInvestments

or http://growingmoney.blogspot.com/atom.xml.

10% APY for Kids Savings Account

Affinity Bank has a special promotion of 10% APY for kids savings account only.

- The Kids Only Savings Account offers a 10.00% APY* on all balances up to and including $500.

- Minimum deposit of only $1.00 makes getting started and adding easy.

- Balances over $500 will be paid at the Gold Savings rates.

- Receive an Affinity Bank Piggy Bank with each new account opened.

Restrictions: Kids must be 16 years old or younger.

This looks like a great deal for parents who wants to start a savings account for their kids, especially with a small amount.

Blog Goal - 1000 Hits

My goal is to achieve 1000 hits by the end of May. It's at about 800 hits so far.

Blogger of the Month - Neville

If any of you don't know Neville, you should take a look at his blog. His blog offers a wealth of information and is regularly updated. He is a senior in college but seems to have a lot of experience making money already. He is a very enthusiastic and energetic intelligent guy who also carries an outgoing personality and a positive attitude. I don't know him personally, but he does show a lot of himself on his blog.

His water experiment is a good example. He bought two dozens of water bottles and hired a "bum" on the street and he shamelessly sold water at the intersection of a highway. He ignored all comments from the drivers and questions from kids and parents. In spite of all the eye stares, he completed the experiment, and it was a success.

He also has a lot of online business making extra income for him. He single-handedly created the Fancy Blog in 15 minutes by himself. That shows how fast he acts on his ideas. He is not just talk; this guy takes actions too. That's definitely a good role model.

Neville seems to be well educated and has the drive to success. He also has a great sense of humor and some art skills he likes to play around with. Check out his site, Neville's Financial Blog

Money-Making Idea #6 - Turn Hot Deals to Cold Cash

When I was in college, I was hooked on hot deal websites and I blew a lot of money on it. Sometimes I would have to buy multiple items to use a dollar off couple. Then I would end up with stuff I don't need. Eventually, I figure out I could sell some of the stuff I bought for a small profit. The biggest profit margins I get are the free-after-rebate products. Say, I picked up a $40 software and send in a $40 rebate, I would end up getting the product for free. Then I would sell it on a forum or ebay for like $5 or $10. The profit margin was off course huge, like infinity!!, but the actually profits and time spent was not alway so worth it.

If you look carefully on the hot deals, sometimes you can get pretty good deals on products that has a lot of demand. One product that I used to buy often was routers. Sometimes they have rebates for them, making the price really hot. I could get a $50 router for $20 after rebate and sell it on a forum or ebay for $40.

I did follow this money-making idea for a while during college, so it has been proven. I wasn't so aggressive and I was picky so I didn't earn too much. I only picked products that I would keep if they doesn't sell and I would only sell one or two items at a time. The risk for me was relatively safe as I spent on average of $20 or less per product and I sold them out pretty quickly. I made about $1000 in a year's time. Afterwards, I got tired of packaging items and going to the post office. Actually, I was okay with packaging items, but I hated to go to the post office because it was so out of my way.

to the right side bar.

to the right side bar. . It was the first time for one of my friends so I accompanied her at the 2/4 table. There were two seats available on the table so we sat there. On one of the games, my friend had pocket Aces. She kept raising but she lost to someone who had a straight. On the next immediate round, I had

. It was the first time for one of my friends so I accompanied her at the 2/4 table. There were two seats available on the table so we sat there. On one of the games, my friend had pocket Aces. She kept raising but she lost to someone who had a straight. On the next immediate round, I had  . It was a total coincidence. There was another Ace on the flop so I raised the bet. I claimed the pot with 3 Aces. My friend was so pissed because she lost with pocket Aces on her round. On another hand, I took out a trip Jacks with a full house of Four's. It was pretty fun. I doubled my initial funds at one point, but I gave some back later on. I started to lose my patience after three hours of sitting there and started chipping away money. My friend lost all her money before me and we left at that point. She was complaining about about her loss and her hand with the pocket Aces, so I bought her

. It was a total coincidence. There was another Ace on the flop so I raised the bet. I claimed the pot with 3 Aces. My friend was so pissed because she lost with pocket Aces on her round. On another hand, I took out a trip Jacks with a full house of Four's. It was pretty fun. I doubled my initial funds at one point, but I gave some back later on. I started to lose my patience after three hours of sitting there and started chipping away money. My friend lost all her money before me and we left at that point. She was complaining about about her loss and her hand with the pocket Aces, so I bought her  . I won some money there. I bet very little though. When it comes to gambling, I play ultra conservatively and I have a cap. In the very end, I netted around $40. One of my friends lost over $200 and was very upset. Another one won over $400 and took all of us out to dinner.

So, as you can see. Sometimes you win, sometimes you lose, but always remember: Casino is not a place for you to get rich. Play for entertainment, not greed.

. I won some money there. I bet very little though. When it comes to gambling, I play ultra conservatively and I have a cap. In the very end, I netted around $40. One of my friends lost over $200 and was very upset. Another one won over $400 and took all of us out to dinner.

So, as you can see. Sometimes you win, sometimes you lose, but always remember: Casino is not a place for you to get rich. Play for entertainment, not greed.

and

and  images.

My feed site is

images.

My feed site is